What Beyond Meat got wrong in product innovation

Beyond Meat went from Wall Street darling to problem child as their “growth above all” strategy faltered. Was part of the issue their innovation execution? In their haste to launch new products, it seems Beyond Meat took some risks and made some basic errors. The risks did not pay off. The errors cost a lot and hit sales growth. Here’s what I learned from a Wall Street Journal article on the troubles at Beyond Meat.

A lot of people are talking about Beyond Meat

Beyond Meat has been in the news recently but for all the wrong reasons. From a share price of $186.83 on 26th January 2021, Beyond Meat’s sales have slumped, it’s profitability has plunged and their shares were worth $13 on 5th January 2023. They announced a workforce reduction of 19% in October 2022 and have refocussed their operating model from “growth above all” to one that “prioritises positive cash flow and sustainable growth” (quotations from Ethan Brown, Beyond Meat CEO).

So, what went wrong and was any of it due to innovation failings?

Clues in this Wall Street Journal article

This Wall Street Journal video article outlines the main elements contributing to the sales and profitability decline. Sure, increased competition played a large part, but I noticed that some of the mistakes are related to how they executed innovation. In particular the scale-up and industrialisation of new products.

Before we dive into the Beyond Meat experience, it’s worth understanding the general context of the company.

The Beyond Meat context – a fast growth strategy

Since its creation in 2009, Beyond Meat pursued a rapid-growth strategy to be first to market. They were looking to grow rapidly by:

Beyond Meat invested heavily in innovation

They established innovation centres in the US and China and invested 14.4% of 2022 sales revenue in R&D.

Beyond Meat were clear about the importance of New Product Development

“A key element of our growth strategy depends on our ability to develop and market new products and improvements to our existing products that meet our standards for quality and appeal to consumer preferences”

Beyond Meat IPO prospectus, 2019

Even though Beyond Meat saw innovation as key and gave it significant resources, they still made some innovation mistakes according to the article. So what were they?

None of these three innovation mistakes are exceptional. I’ve seen similar things in my own career and many of you will have too. Also, they can be avoided by focussing on the industrialisation stage of NPD, ensuring good governance and processes, clear roles and responsibilities and making sure there are enough resources to deliver.

For me, these mistakes highlight that scale-up and industrial implementation was the weakest link in the Beyond Meat NPD process. However, they also suggest some other potential underlying issues at the root of the innovation failings. Issues that Beyond Meat will also need to address.

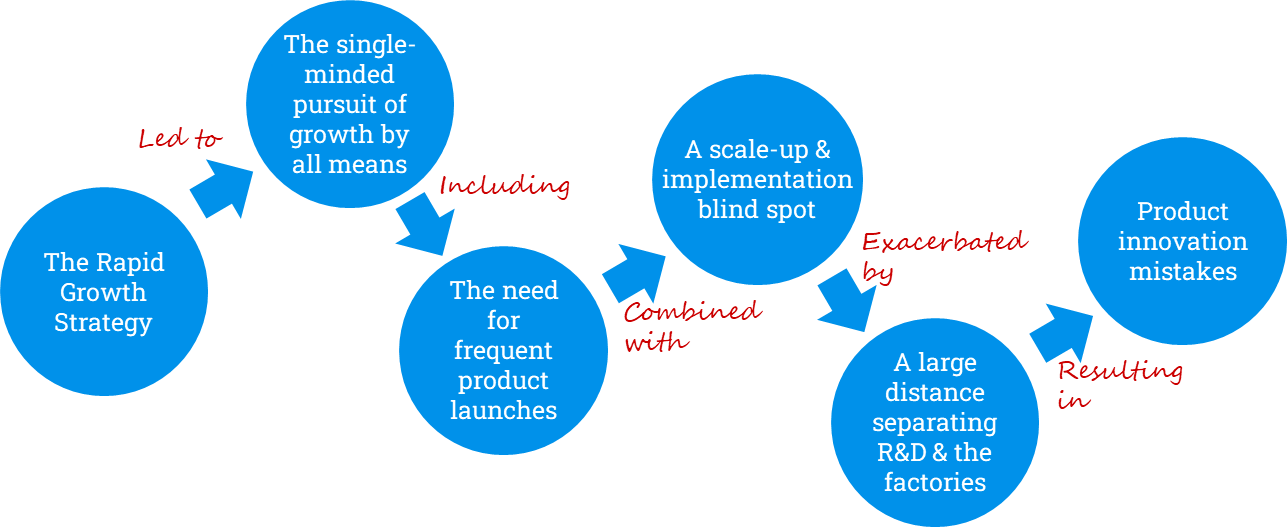

Are these four issues behind the innovation mistakes highlighted in the article?

Beyond Meat’s “rapid growth” strategy drove the high workload across the company, including an accelerated rhythm of new product launches. This essentially put the organisation under strain. It’s a young, dynamic company so that goes with the territory. It’s also not a problem if the organisation is set up to deal with it. But Beyond Meat potentially underestimated what was needed to successfully industrialise new products. They also had the bulk of R&D several thousand kilometres from the main factories. This combination of factors meant that when the pressure was on, mistakes started to happen in the later stages of NPD.